Environment, Social and Governance (ESG) is now sitting as one of the top four priorities for Treasurers around the globe, with Europe leading the way. Nearly all industries are coming under increased scrutiny from customers, suppliers, funders, investors, and regulatory bodies.

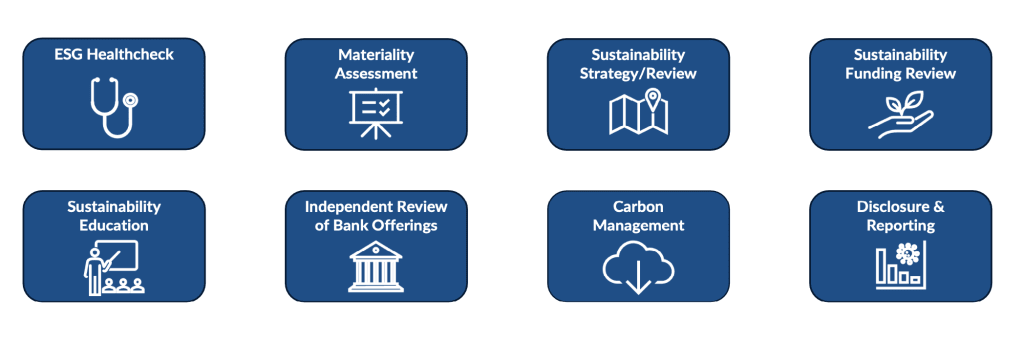

Organisations need to recognise sustainability issues as a whole, and Treasury can be an integral part of the overarching strategy. However, not all businesses in New Zealand have a formal process, sustainability strategy, or a dedicated team to focus on sustainability. To this end, Bancorp Treasury has established a new service pillar, with a team of seasoned practitioners in the area of ESG governance and strategy development, to assist organisations and Treasurers to implement sustainability in their business.

How strong is the financial sustainability of your business?

Undertaking an ESG Healthcheck is a good starting point in considering the key sustainability risks your business could be facing now and into the future, especially if you are in a high-risk industry.

Have you met with your funder recently and will traditional funding exist for you in the future? Answering no to this question would indicate that your business could benefit from a Sustainable Funding Review.

If you already have a sustainability strategy in place, is it linked to your financing and do you have a transition plan in place to track progress towards achieving targets? A Sustainable Funding Review may assist, along with the establishment of ESG Dashboard Reporting.

Finally, if you have questions on any of the following, we can help.

- Climate Related Disclosures

- Scope 3 emissions

- Modern Day Slavery policies

- Supplier Code of Conduct

The Materiality Test

The challenge is to find the balance between pragmatism and sustainability. Our recent Treasury Trends issue discussed this issue in-depth, but the key when establishing a sustainability framework is understanding what is material.

A Materiality Assessment helps an organisation to understand the current state and to engage with stakeholders to gain insight on what ‘matters most’. Along with any decision to allocate resource to this area, the materiality assessment is a critical step in applying the overlay of common sense and pragmatism.

Financing

A Sustainable Finance Review will help identify whether consideration should be made to refinance some, or all, funding with ‘sustainable finance’.

Ordinarily this is by way of green, social, ‘use of proceeds’ or sustainability-linked loans or bonds. For ‘use of proceeds’ funding, the funds are for the construction or refinancing of green or social projects. Sustainability-linked funding provides a level of accountability for an organisation by setting sustainability performance targets (SPT) to the cost of funding, for example margin and line fees.

The achievement of targets is ‘rewarded’ with a reduction in the margin but if a target is not met, there is a ‘penalty’ with either an increase to the margin or no change. The establishment of SPTs and Key Performance Indicators (KPI) will need to be verified by a Second Party Opinion (SPO) to ensure that the targets set are material and ambitious for the organisation. This is to avoid ‘green washing’, where an organisation acts or behaves in a way that makes people believe that it “is doing more to protect the environment than it really is”.

Reporting

Globally, reporting bodies are aiming to standardise the reporting requirements in financial filings. For example, in New Zealand, the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) on governance, strategy, risk management, metrics and targets, have been incorporated into the Aotearoa New Zealand Climate Standards issued by the External Reporting Board (XRB).

It is now mandatory for large NZ corporates that meet the criteria to file climate related disclosures (also referred to as climate statements) on the Climate-related Disclosures Register.

Do you know whether your organisation is captured by these requirements?

Insurance impact

In addition to discussions most are having with their banks in this area, insurers are key to the way most organisations are going to fare in the future. By actively addressing environmental risks and promoting sustainability, insurance companies are better equipped to mitigate their own losses and contribute to climate resilience. Your business will need to fit into an insurer’s risk framework to secure cover at a reasonable cost.

For those that cannot accurately identify and monitor risk, the outlook will be bleak from an insurance perspective. We are already seeing some areas of business becoming uninsurable due to climate zone risks.

And, of course, there will be a growing number of customers and suppliers that are seeking evidence that your business has alignment with their own sustainability ambitions.

We can help

We understand that the area of sustainability within the finance and treasury function can be daunting and the increasing use of acronyms and terminology can be overwhelming. Whether you have undertaken sustainable finance or do not know where to begin, we can help.

Download our one-pager on our Bancorp Treasury service offering.

We are also available to run an education session on Sustainability for Treasury with your own team. Contact us to find out more.