Our last blog in the new ‘normal’ series, focused on negative interest rates – this time we take a look at the issues that could be presented by a negative Bank Bill Benchmark Rate (BKBM).

Firstly, it is important to distinguish between the different interest rates. The OCR is set by the Reserve Bank (currently 0.25%). This is the interest rate that commercial banks receive for holding surplus cash in their settlement accounts with the RBNZ. This strongly influences the supply and demand for Bank Bills, captured by the BKBM interest rate benchmark. The BKBM benchmark underpins most corporate loan documentation and interest rate hedging structures and is therefore most important to corporates.

Food for thought

Although the RBNZ has reiterated that the OCR will remain at 0.25% until March next year, the potential for a negative interest rate environment beyond this commitment means borrowers need to consider the implications of this before making long term interest rate hedging decisions.

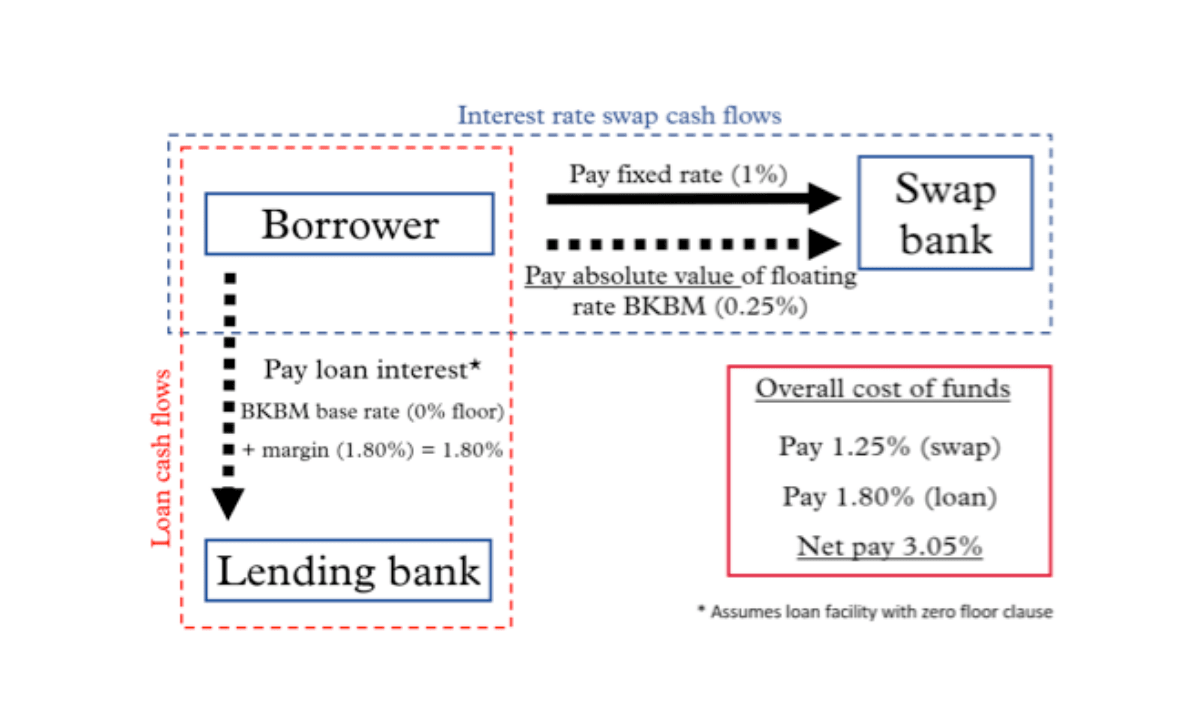

If BKBM were to go negative, there are several complications that arise, the key one being a mismatch between the loan facility with the zero floor and the interest rate swaps which many corporates use to hedge the risk of changes in interest rates. This is a material issue, as the intention of the swap should be to perfectly offset the interest rate movements. As swaps do not typically have a zero-floor provision, under a negative BKBM scenario the swap will actually end up costing the borrower more than the agreed fixed rate. The mismatch between the swap cashflows and the loan interest payments may also lead to unwanted ineffectiveness for those that hedge account.

Strategies to offset negative interest rates

There are a number of hedging strategies which may help avoid or reduce the impact of negative interest rates. Hedging via interest rate caps has become more common in Europe, where negative interest rates have already been a reality for a number of years. Fixed rate loans may also increase in popularity. For those larger institutions with access to debt capital markets, maintaining a balance between ‘pay fixed’ swaps and ‘receiver’ swaps (those swapping back fixed rate bond issuance for example), can both mitigate the impacts of negative interest rates and reduce derivative valuation movements. Similarly, while most borrowers will be unable to avoid the zero-floor clause in their loan documentation, our corporate finance team have specialist expertise in optimising funding structures and in lender negotiations.

This is a complex issue and will depend on your own borrowing and hedging structures, and ultimately, the path of central bank policy over the coming months. If you would like to discuss your bank loan documentation or interest rate hedging strategies, please contact Bancorp Treasury.

This is our fourth blog in our Navigating the new ‘normal’ series – have you read…

– NZ Bank Market Insights

– Reviewing forecasts and exposures

– Negative interest rate policy (NIRP)